Many HR professionals are gearing up for the 2022 “open enrollment” season, where employees have an opportunity to change their benefits and enroll in new benefits or programs offered by their employers.

This year’s open enrollment process will be like no other. With continuing COVID-19 concerns, decisions on when/if to bring employees back to their workplaces, strengthen hybrid working norms, and new legislation, additional complexities have created novel considerations like never before. In addition to the more standard open enrollment issues of new health care and life insurance premium costs, out-of-pocket maximums, co-payments, and family status changes, there are many challenging and potentially confusing decisions to be made in a short amount of time.

According to Mercer, many unique issues need to be considered for 2022, leading to an extraordinary number of employee questions. Number one on Mercer’s list is COVID-19 considerations for group health plans that will likely continue into 2022. When strategizing for 2022, employers should review the continuing coverage mandates, federal and stage agencies’ various COVID-19 relief, and 2021 communications to plan participants about pandemic-related covered benefits, and relief from certain group health plan deadlines. Some employers may want to continue certain benefit enhancements beyond the required coverage period, while others may wish to revert to pre-pandemic terms. In either case, communications with plan participants and plan documentation are essential. Opportunities to expand telehealth, employee assistance programs (EAPs), and on-site clinics may continue into 2022. Congress is working to make some temporary relief for telehealth programs permanent.

Another issue, according to Mercer, is transparency for group health plans. Employers should prepare to comply with final transparency in coverage rules for group health plans, along with several new transparency requirements under the 2021 Consolidated Appropriations Act (CAA), effective for plan years beginning on or after Jan. 1, 2022. Regulators plan to issue additional guidance on the CAA’s transparency requirements, but plan sponsors must make good-faith efforts to comply in the interim. Take time to review the price disclosures that hospitals are making public in 2021 to comply with the final hospital transparency regulation.

In addition, a federal law prohibiting surprise bills for certain services takes effect for providers (including air ambulances) and facilities on Jan. 1, 2022 (and for group health plan years and individual/group health insurance policies beginning on or after that date). The No Surprises Act, adopted as part of the 2021 CAA, builds on parts of the ACA by creating comprehensive patient protections against surprise medical bills. A recently released interim final rule (Part I) provides employers and plan sponsors some compliance guidance, although additional regulations are expected later this year and in 2022. Employers should review the new law and rules and confer with third-party administrators (TPAs) and carriers to prepare plans for compliance. Mercer advises plan administrators will need to adapt claims administration processes to comply with tight time frames, apply new cost-sharing and provider-payment procedures, and provide new disclosures in plan documents and explanations of benefits (EOBs), among other requirements.

The hot debate among benefit experts is whether employers should raise health care premiums for employees who are unvaccinated for COVID-19, as they have done with cigarette smokers or those who do not participate in wellness programs. Companies making this choice will have a bevy of new questions to answer.

In “normal” times, open enrollment questions from employees tend to swamp HR and benefits team members. The inquiries are expected to soar this year. Why not put in place a technology solution that installs in existing collaboration tools so that accurate answers are provided to employees in a convenient and consistent manner? Why not use a technology solution that includes a knowledge base of open enrollment questions for you to simply edit/update and use?

MeBeBot’s Intelligent Assistant installs as an App in Teams, Slack, or as a web chat (within SharePoint or your company Intranet), so that your employees’ open enrollment questions are answered 24/7, from mobile or computer devices. MeBeBot’s Customer Success Team analyzes the types of questions employees are asking daily and ensures that the AI Chatbot responds accurately. By reducing the hours of time that HR spends manually responding (via phone, email, messages or even help desk tickets) to the plethora of open enrollment questions asked by employees, valuable time is gained to focus on other pressing priorities and initiatives.

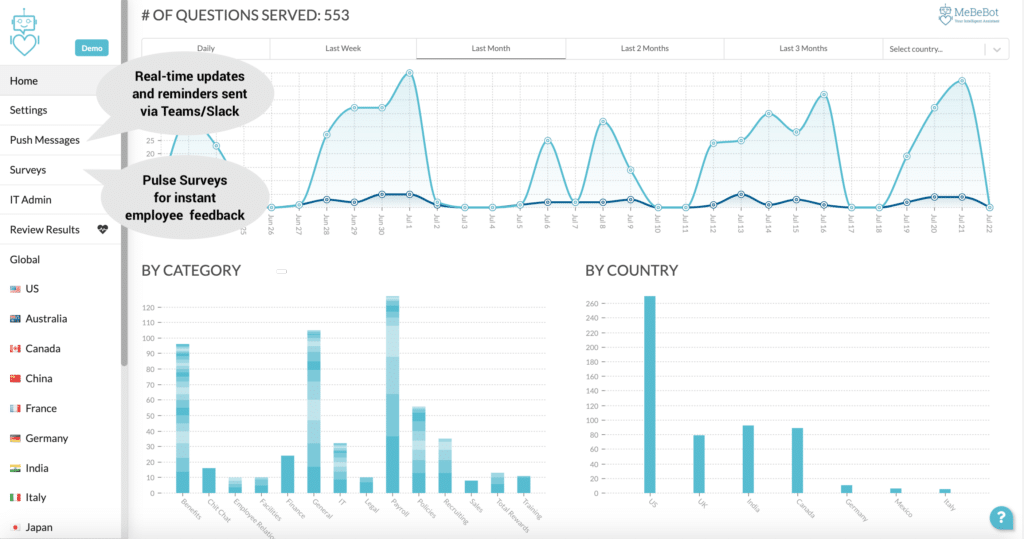

Our customers value and rely on MeBeBot’s Intelligent Assistant not only to answer open enrollment questions, but they leverage the “Push Messaging” feature to schedule important employee reminders of due dates, tasks and deadlines surrounding open enrollment.

MeBeBot’s dashboard not only provides real-time usage information (from the types of questions employees ask, when they ask them, and from what geographic region), it also surfaces frequently asked questions so that HR can quickly respond. Push Messaging can then be used to send out updates and clarify key concerns as a proactive measure.

If you are concerned that it is too late to launch MeBeBot, don’t worry. It’s not too late, as you still have time! MeBeBot installs inTeams, Slack, or as a web chat in minutes. By using our curated knowledge base of hundreds of questions and answers, you can launch MeBeBot in days to weeks to support employees across the globe.

If your budget is tight and you think AI Chatbot Solutions are outside your reach, think again. MeBeBot is affordable and accessible to all company sizes, as our pricing is determined on a per employee, per month software-as-a-subscription (SaaS) basis. As a “bot in a box,” the installation and set up process is simple and can be accomplished by non-technical business users. And, it’s easy to update answers to questions to link your employees to helpful videos, summary plan descriptions, and benefits summaries, providing more detailed answers conveniently. And, our Customer Success Team helps guide you through the process to help answers your questions and launch your Intelligent Assistant within weeks.

Our customers have seen a return on their investment in weeks to several months, with a reduction in the volume of questions by over 50% to 75%, saving $50,000 to $250,000 in costs. That’s real money! The return comes from freeing up your HR staff’s time from answering the common questions and saving your employees time with prompt answers, improving overall productivity. Our customers use MeBeBot year round, to answer commonly asked questions for all areas of HR, IT, Facilities, and Operations—not just for open enrollment.

Click here to calculate the Return-on-Investment (ROI) you can gain using MeBeBot today!

Why have a painful open enrollment experience when the technology exists to make it pain-free and also helps your bottom line? You still have time, but don’t wait too long! Please reach out to one of our consultants today, who can provide you and your employees with a fantastic, affordable, and easy to launch solution.