Welcome to the exploration of the dynamic relationship between two powerhouses within the corporate realm – Finance and Human Resources (HR). Traditionally, these functions existed in separate silos, each with their unique responsibilities and objectives. Finance Officers tirelessly manage the organization’s financial health. While Chief People Officers (CPOs) passionately dedicate themselves to nurturing and developing the workforce. The gulf between HR & Finance led to a disconnect, with HR often perceived as a mere cost center and administrative arm. A paradigm shift is underway, where organizations recognize the value of collaboration between Finance and HR.

This article will unlock the secrets to enhanced business effectiveness and bolstered employee retention. Through the voices of experienced CFOs and HR leaders, I will talk about the:

(1) Pivotal role of headcount in the overall cost structure

(2) Shared goal of crafting impeccable wellness & benefits programs

(3) Transformative impact of culture on driving employee retention

HR Collaboration and Alignment with Finance

We continue the recurring theme of “One Vision, One-Team, One Employee Experience.” Central to advancing the digital employee experience is to develop a budgeting process that balances the organization’s strategic goals with employee well-being and development. This collaboration ensures that financial decisions consider the impact on its people and vice versa.

The concept of “shared value” is key. When considering an organization’s needs, whether compensation & benefit plans, culture, or community impact, decisions should bring value to all key stakeholders (customers, investors, and employees). If investment plans leave one out, it is unlikely to be successful and a budget waste. Thinking through budgeting decisions in this way can be helpful.

Emily Couey, a fractional CPO, noted in her experience that workforce planning was separate from the budgeting process. It did not require the CFO to finalize a budget. Emily found this resulted in negative downstream effects when approved head counts, hire dates, and budgeted salaries were disconnected from salary bands and recruiter bandwidth. By creating a partnership with her CFO, she was able to include a step in the budgeting process for HR to provide feedback on the budgeted salary and hire dates before the budget is finalized and approved.

Finance Collaboration and Alignment with HR

In Emily’s example of workforce planning, finance is the domain expert on operating expenses. Yet, the Chief People Officer better forecasts replacement hires based on attrition trends and the current makeup of the workforce. Finance may “forecast” attrition by qualitative input from department heads on what they expect from attrition, or they may average prior years’ trends and assume it will replicate. In bringing together the knowledge of the two departments, Nick Jesteadt, analytics leader, found it was better to model attrition likelihood based on:

(1) An employee’s tenure;

(2) The department or cost center that they are in;

(3) The employee’s level; and

(4) Their compensation versus the market.

Ultimately, simulating the most likely attrition outcome for each group. This gave the team a more realistic picture of replacement attrition for finance to use in their modeling alongside any new budgeted positions or hiring.

How Collaboration Enables Creative Budgeting

Through effective teamwork, HR can collaborate with finance to be creative with the budget. With a common understanding of the company’s business and financial objectives, HR and finance agree on what is allotted for items like benefits and payroll. If a survey of the current workplace environment has been conducted, there may be waste areas (like unnecessary technology, unused software, or inefficient procedures), that could be streamlined to lower costs. Additionally, a review that includes feedback from staff can offer additional information and ideas for savings.

Alternatively, you can redistribute budgets or discover shared investments that benefit several departments. Finance could look to HR for advice on which type of talent is needed to fill a skill gap. And instead of requesting money, you might be able to find it. For example, hiring a fractional worker provide the needed expertise while investing in and training your current employees and reducing expenses.

Overcome Challenges and Resistance By Understanding ROI

There is lingering resistance to bringing HR into forecasting and budget conversations. CPOs noted the burden of earning credibility and building trust with their CFO partners. Both sides noted a lack of acumen and access to data has “hampered” HR from being able to speak with authority on this topic.

In my conversations, speaking the language of ROI was key to building credibility. Then maintaining trust was accomplished through regular, consistent communication. Many suggested a recurring meeting between the CEO, CFO, and HR leader to discuss progress against investments and success measures tied to business objectives. The first step towards speaking to ROI is clarity of alignment on business priorities. HR leaders, in partnership with the CFO and CEO, can then identify the people-related expenditures that tie to business outcomes through the lens of ROI. To do this,

HR leaders can partner with finance to understand the current and future desired state of the company’s financial position. Start by understanding the overall company expenses, budget, and relative % department costs. Also, it is important to know how the budget is built. CFOs build budgets differently depending on the business and how the company matures financially.

Ken Wong, fractional CFO

Moving Finance & HR Forward

Emily Couey mentioned her favorite questions to CFOs: Is the budget built bottom up? Does each department have a target spend as a percent of revenue? These questions inform the “pool of money” you must work within. Working closely with your finance partner to take that data and convert it into ROI and then set the KPIs to manage to that would be a good outcome.

Menaka Chang, a fractional CPO, uses the RICE (Reach, Impact, Confidence, and Effort) framework to show potential ROI.

(1) Reach: involves assessing how many people the initiative will affect

(2) Impact: the level of potential benefit,

(3) Confidence: the certainty of achieving this benefit

(4) Effort: the resources required.

Nick Jesteadt finds that utilizing a cost/benefit analysis to show ROI is helpful. Since retention, engagement, diversity, performance, and productivity can be abstract, it is important to try and assign a monetary value to show what investments will cost and likely yield. Make conservative assumptions (just like financial models do), and if the benefits outweigh the cost, often senior leaders “get on board.” It is important to measure the impact, such as engagement or retention, so that the HR model can be adjusted. It’s all about being agile in your modeling as you use and refine them and ensuring that you’re thinking through a financial lens when justifying new spending. This use of analytics builds a common lens for finance and HR to look through together.

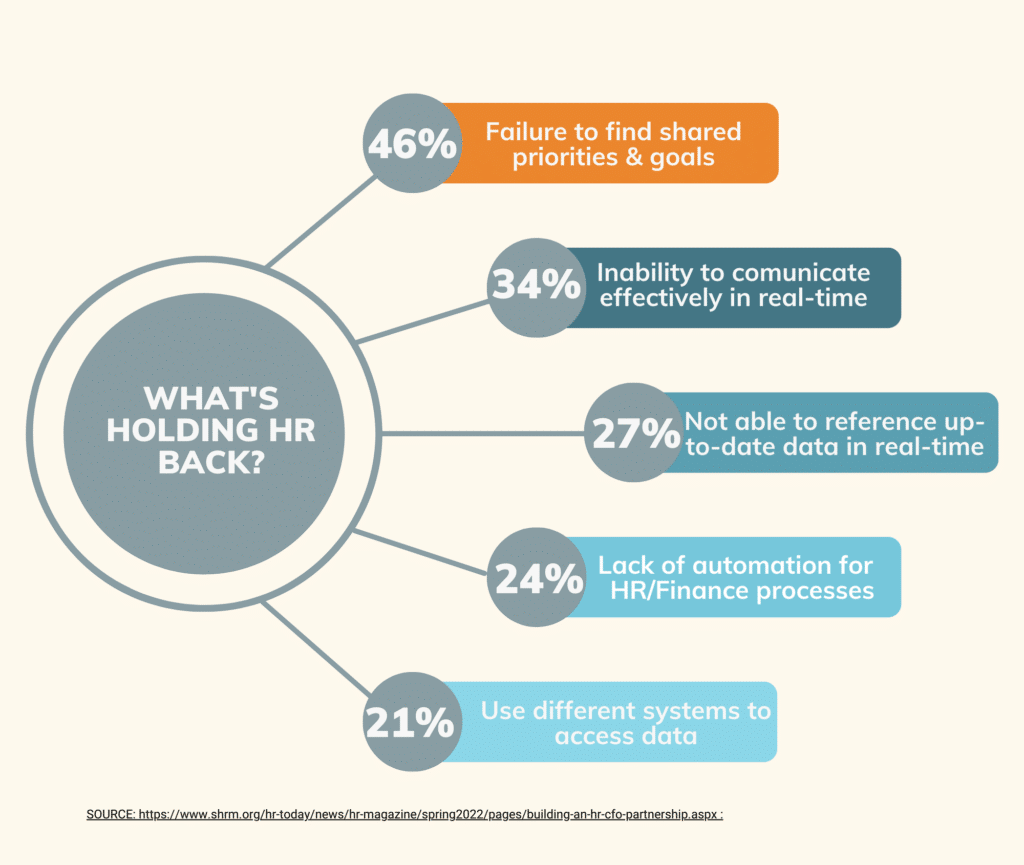

Finance & HR identify, plan and budget for the now and future of work. A recent survey of HR Leaders by Oracle, surface the top 5 obstacles facing HR and their relationship with Finance.

Incorporate People Analytics & Embrace Technology

People analytics is the universal language of Chief Financial Officers and Chief People Officers (CPOs) can understand. By analyzing employee data, finance and HR leadership make informed decisions about resource allocation and investments in their workforce. This data-driven approach optimizes budget allocation while promoting employee satisfaction and productivity. Finance and CPOs understand the transformative potential of technology in streamlining budgeting processes. By adopting advanced financial management systems and automation tools, they reduce manual efforts, enhance accuracy, and improve the speed of budgeting cycles. These technological advancements empower organizations to allocate resources more strategically and adapt to changing market dynamics effectively.

Nick Jesteadt mentions that not only do you need to have a healthy HCM for collecting transactional data (onboarding, offboarding, or time off) you need to have a good ATS, a good data warehouse/data lake, the ability, and willingness to “connect” HR data with data in Finance and across the corporate space. In doing so, you can “blend” a data story that talks to all. You also benefit by having HR data expertise, allowing them to color the data/models with the necessary nuance.

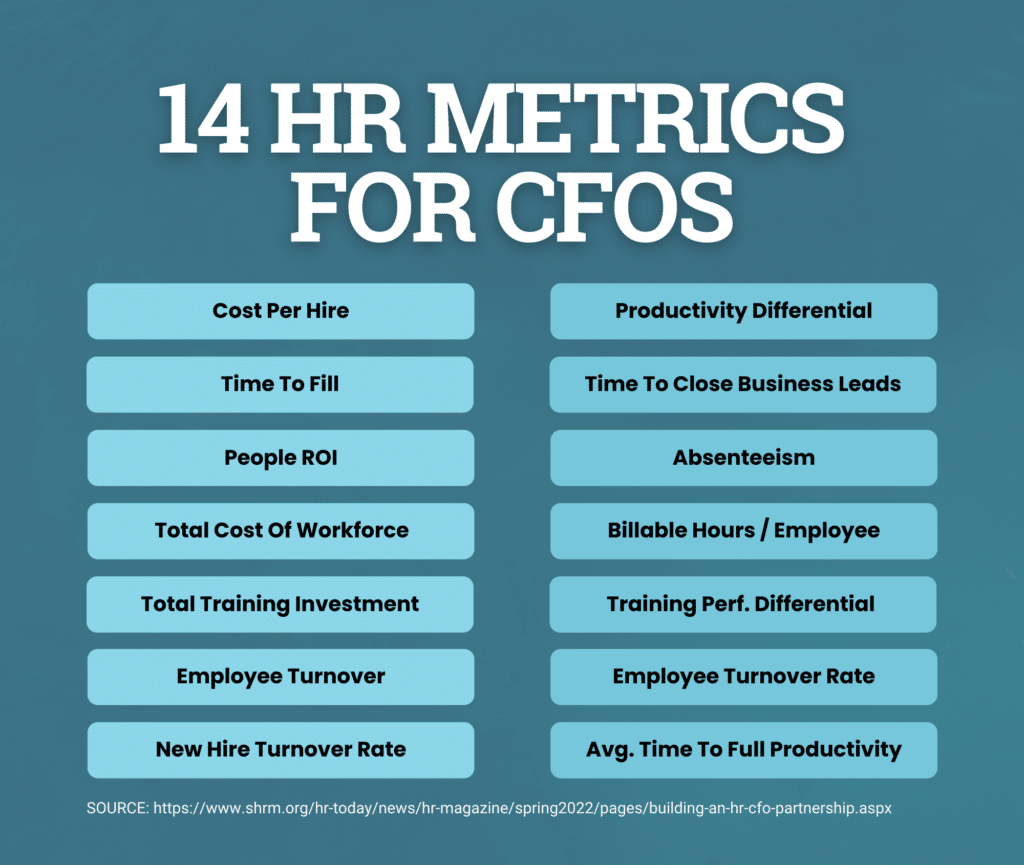

HR Metrics Important To Finance

When asked what specific metrics or KPIs HR leadership should focus on when tracking the ROI of HR initiatives, CFOs mentioned attrition as a key KPI. Nick mentioned that voluntary attrition, when controlled for other factors, can be a big signal as to what is working across teams, initiatives, etc. Beyond that, he uses productivity if you have metrics in that space (quota attainment among sales), but you can also use performance reviews or revenue per employee. He firmly believes in leveraging engagement data if you have pulses more frequently than annually.

You can ask specifically about the reaction to any company investment to see if employees feel it is worthwhile. Then, barebones utilization. If you invested in an initiative or technology to help or engage employees: are they using it? What is the cost per active user, and is that going up or down? These KPIs can also help with adoption initiatives.

By integrating financial and worker considerations, organizations develop a budgeting process that aligns with strategic objectives while prioritizing employee well-being and development. This people-centric approach to budgeting enhances the overall employee experience and drives business success. By investing in employee development, creating a positive work culture, and optimizing financial resources, organizations can drive sustainable growth and success.