Funding innovation often stands as the key differentiator, HR (Human Resources) and Finance leaders find themselves at the forefront of a crucial conversation. Unlocking alternative ways to budget or fund innovation in the digital workplace is not just a strategic endeavor but a necessity to keep organizations competitive and agile. I had the privilege of sitting down with two leaders, Ashley Womack, CFO (Chief Financial Officer), and Cindy Hartman, Leader of Global Shared HR Services, to delve into this vital topic. The interview navigates through seven pivotal questions, from exploring the domain expertise of HR and Finance to understanding how metrics drive e`xpectations, and from strategic budgeting experiences to innovative approaches like ROI (Return on Investment) calculations and pilot programs. This insightful journey uncovers how HR and Finance are working together as one team to shape the future of workplace innovation.

Meet Ashley Womack and Cindy Hartman plus their CFO and HR leadership Roles

A Chief Financial Officer (CFO), exemplified by Ashley Womack’s role, is a pivotal executive in a company, responsible for overseeing its financial well-being. In Ashley’s current position at Alpha Two, a healthcare software firm under private equity ownership, her role involves managing the company’s financial growth and fostering innovation while ensuring it meets both top-line (revenue) and bottom-line (profitability) expectations. Drawing from her prior experience as the CFO of Abrigo, another software company, Ashley brings a wealth of knowledge to her position. She has spent over 20 years in performance improvement consulting across various business sectors, shaping her perspective on business growth. Her approach centers on achieving a harmonious balance between expanding the company’s operations efficiently and maintaining financial stability. This perspective closely aligns with the core principles and solutions provided by MeBeBot, underscoring the CFO’s instrumental role in making strategic financial decisions that drive the company’s overall success.

The Head of Global HR Shared Services at International Game Technology (IGT), Cindy Hartman plays a crucial role in managing human resources for a company with around 11,000 employees engaged in the casino, slot machine, lottery, and digital gaming sectors. With 13 years of experience at IGT and a long history in HR, Cindy’s current role is particularly exciting and challenging. Cindy is focused on digital transformation and digital services, aiming to explore how these initiatives can positively impact the company’s financial performance and enhance the overall employee experience. This entails adapting to the unique challenges and regulations of the highly regulated gaming industry, making her role both intriguing and demanding. The Head of Global HR Shared Services role is pivotal in shaping the company’s future by leveraging digital solutions to optimize operations and improve the employee journey.

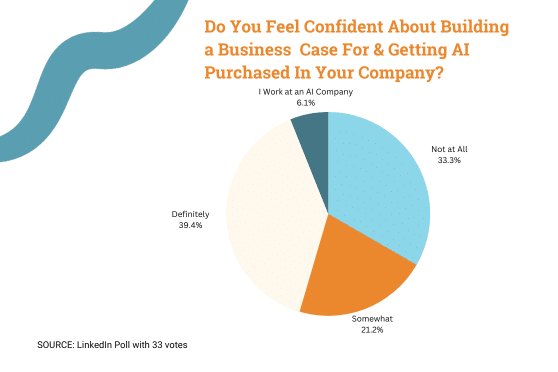

POLL: What is the state of confidence in building a business case and getting AI (Artificial Intelligence) purchased in companies?

The panel discussed the results of a pre-webinar poll on LinkedIn regarding people’s confidence in building a business case for and purchasing AI in their companies. The poll showed that the responses were quite evenly split: 39.4% were confident, 33.3% were not confident at all, and 21.2% were confident.

Beth White, the founder and CEO of Mebebot, explained “I am not surprised to see some uncertainty because many are still in the learning phase about AI. However, she emphasized the importance of asking questions, learning, and having conversations with vendors and industry peers to gain confidence in presenting a business case for AI.”

Ashley Womack, “A bit surprised at the high percentage of respondents who were confident about AI. She suggested that this might reflect how rapidly the market is changing, with AI becoming more mainstream and trusted for everyday productivity. She mentioned the recent rise of AI technologies like ChatGPT and the acceleration of AI adoption, which was not as common a year or two ago.”

What Are the Expectations of Finance and HR Functions with Emphasis on Metrics?

The expectations between HR and Finance include the sharing of key metrics and KPIs (key performance indicators) to align on various aspects related to the workforce and financial management. Here is a summary of what Cindy and Ashley had to say:

Cindy highlighted the importance of sharing HR metrics with Finance, including turnover rate, cost of hire, and time to hire. These metrics are vital for workforce planning and allow Finance to forecast the costs associated with hiring and employee turnover.

Ashley also emphasized the significance of aligning HR and Finance metrics. She mentioned two key areas of focus:

- Employee Retention: Ashley pointed out that employee retention is a critical KPI (key performance indicators) that impacts the organization’s financial health. Metrics related to employee satisfaction, turnover rates, and the cost of hiring and training new employees all contribute to understanding employee retention. High attrition can be costly in terms of recruitment expenses and productivity losses.

- HR Expense Ratio: Ashley suggested evaluating the ratio of HR expenses to the number of employees. This metric helps determine how efficiently the organization is managing its HR costs. An optimized ratio ensures that the organization is investing appropriately in its employees’ well-being without overspending.

Overall, the key expectation is that HR and Finance collaborate to share relevant metrics and KPIs that provide insights into the workforce’s impact on the company’s financial performance. The specific metrics may vary depending on the organization’s size and complexity but should contribute to informed decision-making and cost-effective management of human capital.

Walk Us Through Strategic Budgeting Experiences

The shift from traditional tactical budgeting to a more strategic approach, as discussed by Ashley and Cindy, is a transformative process in financial management. Historically, budgets often followed a routine of replicating prior year’s allocations with minor adjustments. Ashley emphasized the importance of aligning budget decisions with an organization’s overarching strategic goals. She stressed the need to link budget allocations directly to desired business outcomes, urging a forward-thinking perspective that considers long-term strategic objectives, rather than just the current fiscal year. Continuous evaluation and monitoring were also key, emphasizing that strategic budgeting is an ongoing, adaptive process.

Cindy echoed these sentiments, recognizing that effective budgeting blends strategy and tactics seamlessly. In her role at IGT’s HR department, budget planning transcends the typical annual cycle. Instead, it evolves into a continuous, dynamic practice marked by regular workforce planning discussions, often on a monthly or bimonthly basis. These discussions, conducted collaboratively with the Finance team, serve as crucial tools to proactively anticipate staffing needs, formulate retention strategies, and adapt swiftly to factors like attrition. Finance’s active role in approving new positions ensures they maintain visibility into the budgetary implications of HR decisions. Workforce planning has risen to prominence, underlining its pivotal role in aligning budget choices with HR department and organizational objectives.

Both viewpoints underscore the evolving nature of budgeting, transforming it from a once-a-year event into an ongoing, integrated process. This process harmonizes strategy, workforce planning, and budget allocation to achieve business goals. Workforce planning emerges as a linchpin, ensuring budgeting decisions consistently support the organization’s strategic priorities.

Funding Approach #1: Pilot Programs for Strengthening Business Cases

Cindy and Ashley discussed different approaches to funding innovative digital workplace solutions, including pilot programs, ROI considerations, and shared budgets. Here is a summary of their insights:

Cindy provided insight into IGT’s strategic approach to adopting MeBeBot, emphasizing the company’s commitment to optimizing its business processes. Initially, IGT considered the prospect of creating an in-house digital solution, but challenges related to time constraints, resource allocation, and technical expertise prompted them to explore alternatives. Their solution involved a 30-day pilot program, which focused specifically on addressing US payroll and benefits queries within a select group of HR facilities. This pilot phase enabled IGT to collect immediate feedback, evaluate the platform’s user-friendliness, and gauge its success based on factors like ease of use and overall employee experience. Encouraged by the positive outcomes of the pilot program, IGT swiftly transitioned to full-scale implementation of MeBeBot in just six weeks. As they move forward, the company remains vigilant in monitoring key metrics, including the acquisition of new users, the total user base, time savings, and a reduction in support cases, ensuring a thorough assessment of the solution’s ongoing impact on their operations.

Funding Approach #2: ROI Considerations for Innovative Investments

Ashley underscored the importance of considering two fundamental aspects when assessing Return on Investment (ROI): cost avoidance and cost-benefit improvement. In cost avoidance, the focus lies on minimizing expenses through implementing innovative solutions that streamline processes, saving time and resources. This approach involves quantifying the potential monetary savings achievable through the adoption of new methods compared to traditional approaches.

Conversely, the concept of cost-benefit improvement revolves around enhancing outcomes, such as bolstering employee satisfaction or elevating the customer experience, through the introduction of innovative solutions. Here, the calculation revolves around measuring the positive impact on critical business objectives. Ashley provided a concrete illustration of this by highlighting how MeBeBot effectively freed up HR resources, enabling a renewed emphasis on employee training and development, which in turn led to improved employee experiences and higher retention rates.

The calculation of ROI serves as a powerful tool to substantiate investments in innovation, highlighting tangible benefits by either demonstrating cost savings or illustrating the enhanced business outcomes that result from these strategic initiatives.

Funding Approach #3: Shared Budgets and Cross-Functional Collaboration

Cindy and Ashley share their perspectives on shared budgets and cross-functional collaboration in funding innovative digital workplace solutions. Cindy acknowledges the collaboration she has had with various departments such as procurement, legal, and facilities to address generic employee questions and streamline processes. While the budget ownership for their solution lies with HR, the collaboration ensures that other functions benefit from its implementation.

Ashley dives into the finance and budgeting perspective, highlighting two main budget categories: employee costs and IT, including facilities. She emphasizes the flexibility of budget allocation, suggesting that solutions like MeBeBot can span both categories, displaying the potential for shared expenses. Ashley underlines the importance of optimizing budget allocation to align with business goals, ensuring that resources are effectively used to achieve organizational objectives.

Both perspectives highlight the potential for collaboration across departments to fund and implement digital workplace innovations effectively, emphasizing the need for flexibility in budget allocation if the desired outcomes are met. This approach promotes a holistic view of budgeting and resource allocation to support the organization’s strategic priorities.

Funding Approach #4: Re-Imagining Modern Organizational Chart with AI as a Member of the Team

During the discussion, Derek Sidebottom, an engaged audience member, shared a creative and compelling approach to gaining approval for AI, particularly MeBeBot. He introduced the innovative concept of integrating MeBeBot into the organization chart, a strategy he found remarkably potent. Derek pointed out a common challenge with AI: its inherent invisibility, which can make it challenging for individuals to recognize its presence and impact within the organization.

By including MeBeBot in the organizational chart, Derek emphasized that it transforms the abstract into something tangible and visible, making it easier for people to grasp its role and significance. Drawing parallels to historical technology transitions, such as the shift from typewriters to personal computers or the recent surge in video conferencing adoption, he underscored the vital importance of embracing modern technologies and fostering a flexible mindset.

Derek stressed that AI adoption necessitates not only a technological shift but also a corresponding shift in mindset and alignment with broader business objectives. It is not merely about the technology itself but understanding its inherent value and cost in the context of supporting employees effectively.

In summary, Derek emphasized the imperative for organizations to proactively embrace novel technologies like AI and consider them integral members of their teams, aligning these innovations with their overarching business goals while carefully weighing the associated costs and benefits.

What Is the Cost of Ignoring AI / Innovation?

Cindy and Ashley discussed the repercussions of neglecting AI and innovation within organizations. Ashley notes that many businesses prioritize AI for revenue generation but overlook its potential to enhance internal productivity. She emphasizes AI’s role in automating routine tasks, freeing up employees for more valuable work, and potentially improving the overall employee experience over time.

Cindy highlights the impact on talent acquisition, especially in the technology sector. Companies failing to adopt AI risk losing the ability to attract top talent. She stresses the rapid pace of technological change, urging strategic planning and budget allocation for successful AI implementation. Cindy notes a common issue of organizations lacking a well-defined AI strategy, resulting in reactive, ad-hoc approaches instead of forward-thinking strategies.

Both Cindy and Ashley stress the importance of staying informed about AI advancements, strategic planning for AI integration, and recognizing its potential for improving employee satisfaction and efficiency. They also acknowledge AI’s evolving nature, emphasizing the need for ongoing adaptation to new use cases and technologies.

Three Take-A-Ways To Balance Funding, AI, and Productivity

I leave you with three critical take-a-ways that emerged for you to prioritize. Firstly, the importance of recognizing the domain expertise of both CFOs (Chief Financial Officer) and HR leaders is paramount. CFOs bring financial acumen and strategic vision to ensure a company’s fiscal health, while modern HR leaders concentrate on enhancing the employee experience and collaborative efforts across departments. Secondly, the alignment of expectations and metrics between HR and Finance plays a pivotal role. Sharing metrics like workforce planning and turnover rates allows for a harmonious integration of HR strategies into financial planning. Lastly, strategic budgeting stands out as a crucial shift towards a more forward-thinking approach. It involves aligning budget decisions with long-term objectives and continuous evaluation, promoting financial prudence. These insights collectively emphasize the need for collaboration, strategic planning, and a proactive approach to innovation and AI adoption in today’s innovation economy.